Residency for Tuition Purposes: Undergraduate Policies

Undergraduate Residency Reclassification Policies

Read on to learn about residency requirements, deadlines, and everything you need to know about residency for tuition purposes for undergraduate students here at the U.

If you are classified as a nonresident but meet the requirements for a policy or exception for resident status, you may apply to change your status by means of a residency addendum, see details here.

If you have recently been granted a U.S. permanent resident card, asylum status, refugee status, special immigrant visa, humanitarian parole, temporary protection status, or if you have good faith evidence of a pending application for one of these statuses, please see details about House Bill 102 addenda here.

Mandatory Reading for All Residency for Tuition Purpose Applicants

The resources listed here describe the various ways in which you may be eligible for in-state (resident) tuition under the provisions of Utah state law and University of Utah Institutional Policy. Review these materials carefully.

Please note that retroactive residency for past semesters is not granted,

“R512-5.2.1 Application Deadline: Students must meet institutional application deadlines for each term…institutions may not accept applications for resident student status or supporting documentation after the third week of the semester or term for which the student seeks resident student status.”

Residency for Tuition Purposes Calendar

Undergraduate Residency Reclassification Requirements

You will need to show eligibility under an undergraduate residency reclassification policy if you:

- Are an undergraduate student or an incoming graduate student, including those in the Medical and Law programs, if they qualify prior to the start of their graduate studies

- (Graduate students who begin their graduate program as a non-resident are only eligible to reclassify under the Graduate Residency Reclassification Policy.)

- Have completed at least a consecutive 12 month period of residence in Utah

- Are requesting to reclassify for resident student status

The requirements for each policy are listed, and the student must meet ALL requirements and then complete the Residency Reclassification Application, link below for the semester they want to have resident student status.

Undergraduate policies supersedes all other policies except for:

- Military/veteran exceptions

- American Indian exceptions

- Olympic exceptions

- USHE transfer student exceptions

- other State or Federal exceptions

- House Bills 118 and 144.

Residency Citizenship and Immigration Requirements

See Mandatory Reading:

Undergraduate Residency Reclassification Policies

The Undergraduate One Year Rule Policy is the most common policy undergraduate students use to reclassify as a resident for tuition purposes after completing a minimum of 12 months in Utah.

The following criteria is required:

- Residency Reclassification application

- Utah Domiciliary Ties(see tie deadlines here)

- Valid Utah driver’s license

- Valid proof of active Utah voter registration via their voter registration card or a certified letter from the County Clerk’s office.

- Students with granted permanent resident status are exempt from this requirement and can submit a secondary Utah tie.

- Valid Utah vehicle registration, if the student has a vehicle in their name

- If the student is operating a vehicle in Utah that is not in their name, student must submit a copy of the other owner’s vehicle registration, from any U.S. state or territory, that the student is using in Utah

- Tax Independence Documentation

- For not-married students under 24 years old:

- Federal tax return Form 1040 verifying tax independence, showing that the student is not claimed as a dependent on the federal tax return of any person who is not a resident of Utah.

- Either one of the following:

- The first two pages of the student’s federal tax return Form 1040, verifying they were not claimed as a tax dependent of any person, for the most recent tax year, or

- Parents’ or guardians’ federal tax return(s) Form 1040, verifying that they did not claim the student as a dependent, for the most recent tax year

- Either one of the following:

- All tax documents must be verified for submission to the IRS by means of one of the following:

- Tax-payer’s signature on the second page of the 1040 (include IRS Identity Protection PIN if applicable)

- Proof of an e-signature

- If tax returns do not have a signature, other means of verifying submission of the tax return to the IRS will be required

- A copy of an IRS Tax Transcript can be submitted, in addition to the Form 1040, as proof of IRS submission

- Federal tax return Form 1040 verifying tax independence, showing that the student is not claimed as a dependent on the federal tax return of any person who is not a resident of Utah.

- For not-married students under 24 years old:

- Proof of Physical Presence in Utah

- Proof for 12 continuous months prior to the first day of class for the academic term they apply for resident student status

- No more than 29 days total with presence unaccounted for or outside of the state of Utah

- Any days that a student cannot prove their presence in Utah by one of the accepted methods will count against the 29 day total.

- Students are expected to report any days they leave the state of Utah.

- Acceptable proof of physical presence documents here

- Documents used must have 3 pieces of information per document:

- Student’s name

- Exact date or dates

- Event location

- ALL SUBMITTED DOCUMENTATION for proof of physical presence in Utah submitted is subject to review; acceptance is not guaranteed.

Requesting student marries a Utah resident who has been a resident for at least 12 continuous months prior to the date of the marriage.

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s:

- Valid Utah driver’s license

- Active voter registration

- If applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Copy of the student’s marriage certificate verifying the date of the marriage

- Copy of the Utah resident spouse’s Utah state income tax return for the tax year prior to the year of the marriage

- If the spouse did not file state tax return because their parent(s) claimed the individual as a tax dependent, provide a copy of the spouse’s parents’ federal and state tax return(s) for the tax year prior to the year of marriage.

- Copy of the Utah spouse’s valid Utah driver’s license (See Domiciliary Tie Deadlines here)

See USHE R512-5.3.3 for details

The following criteria is required:

- Residency Reclassification application

- Copy of the parents’ federal tax return for the most recent tax year showing the requesting student as a tax dependent of one of their parents (claiming parent does not need to be the Utah parent)

- Proof of Utah parents’ physical “bodily presence (see R512-3.2)” in Utah:

- A copy of their Utah state tax return TC-40 with “Full-yr Resident” marked “Y” for the most recent tax year (see example here)

- For parents with Utah state tax returns TC-40 that answers “N” under “Full-yr Resident?” for the most recent tax year:

- Additional documents proving the parents’ presence in Utah for a full 12-month period, with fewer than 29 days total unproven/out-of-state, will be required

- For parents with Utah state tax returns TC-40 that answers “N” under “Full-yr Resident?” for the most recent tax year:

- A copy of their Utah state tax return TC-40 with “Full-yr Resident” marked “Y” for the most recent tax year (see example here)

-

-

- Parents with the Utah TC-40B Non and Part-year Resident Schedule that proves the timeline the parents’ were part-year residents of Utah:

-

-

-

-

-

-

- Additional documents proving the parents presence in Utah, in combination with the state tax return, will be required

- All documents, Utah TC-40B and others, must total a full 12-month period, with fewer than 29 days total unproven/out-of-state

-

-

- Any form of proof of physical presence in Utah submitted is subject to review; acceptance is not guaranteed.

-

-

- Copy of the Utah parent’s Utah valid driver’s license (See Domiciliary Tie Deadlines here)

- Copy of the Utah parent’s Utah valid vehicle registration (See Domiciliary Tie Deadlines here)

See USHE R512-5.4.1 for details

This includes cases where the employment is for a spouse or parent of a student.

To qualify for this policy, the Residency office must see that the move to Utah for full-time employment came four (4) months, or more, prior to the requesting student’s final submission of the current admissions application to the University of Utah (see Utah Code 53B-8-102(14)(b)(v).

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Signed and dated letter on company letterhead from the Utah employer verifying (see sample letter here):

- Full-time employment

- Verification of employer-requested job transfer or recruitment

- The dates when Utah employment was first:

- Considered, meaning when they applied for the job

- Offered

- Accepted

- Date of move to Utah

- All of these dates concerning the motivation for the move, showing the student applied for school four (4) months, or more, afterwards, shall be considered (see Utah Code 53B-8-102(14)(b)(v).

- If the requesting student is under 24 years old and not married, they must provide proof that they were not claimed as a tax dependent by out of state parents or guardians on their federal tax return for the most recent tax year

- For parent employment, the requesting student must provide a copy of their parents’ or guardians’ federal tax return for the most recent tax year verifying they were claimed as a dependent

See USHE R512-5.4.1 and also Utah Code 53B-8-102(14) for details.

For School:

To qualify for this policy, the requesting student must have been a resident of Utah for at least 12 continuous months prior to leaving the state for educational purposes.

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration, and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Verification of the requesting student’s non-residency status at the out-of-state school and payment of non-resident tuition

- Copy of the requesting student’s Utah state tax return for the most recent tax year and for all years that the requesting student resided out of state

- If the requesting student was required to complete Form TC40-B, they must provide a copy of it.

- If applicable, a student who is a tax dependent of Utah parents, the student must provide copies of their Utah parents’ federal tax return proving they are a tax dependent, and Utah parents’ state tax returns for the most recent tax year and for all years that the requesting student resided out of state

For Ecclesiastical Volunteer Service:

To qualify for this policy, the requesting student must have been a resident of Utah for at least 12 continuous months prior to leaving the state for ecclesiastical volunteer purposes.

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration, and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Letter verifying the requesting student’s service beginning date and return to Utah date from:

- The student’s local ecclesiastical leader

- Or from the returning student’s ecclesiastical mission organization leadership

- Copy of the requesting student’s Utah state tax return for the most recent tax year and for all years that the requesting student resided out of state.

- If the requesting student was required to complete Form TC40-B, they must provide a copy of it

- If applicable, a student who is a tax dependent of Utah parents, the student must provide copies of their Utah parents’ federal tax return proving they are a tax dependent, and Utah parents’ state tax returns for the most recent tax year and for all years that the requesting student resided out of state

For Government Volunteer Service:

To qualify for this policy, the requesting student must have been a resident of Utah for at least 12 continuous months prior to leaving the state for volunteer purposes.

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration, and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Letter verifying the requesting student’s service beginning date and return to Utah date from the government organization

- Copy of the requesting student’s Utah state tax return for the most recent tax year and for all years that the requesting student resided out of state.

- If the requesting student was required to complete Form TC40-B, they must provide a copy of it

- If applicable, a student who is a tax dependent of Utah parents, the student must provide copies of their Utah parents’ federal tax return proving they are a tax dependent, and Utah parents’ state tax returns for the most recent tax year and for all years that the requesting student resided out of state

For Temporary Employment:

To qualify for this policy, the requesting student must have been a resident of Utah for at least 12 continuous months prior to leaving the state for temporary employment.

The following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration, and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Letter, on company letterhead, from the temporary employer detailing work beginning date and return to Utah date (additional documentation may be requested).

- Copy of the requesting student’s most Utah state tax return for the most recent tax year and for all years that the requesting student resided out of state.

- If the requesting student was required to complete Form TC40-B, they must provide a copy of it

- If applicable, a student who is a tax dependent of Utah parents, the student must provide copies of their Utah parents’ federal tax return proving they are a tax dependent, and Utah parents’ state tax returns for the most recent tax year and for all years that the requesting student resided out of state

See USHE R512-5.3.5.3 for details.

A student who relocates to Utah for reasons related to divorce, the death of a spouse, or long-term health care responsibilities for the student’s spouse, parent, sibling, or child

There is no provision for students who are living in Utah, trying to establish their residency for tuition purposes, who then need to be outside of the state of Utah for longer than 29 days due to unfortunate circumstances.

For moving to Utah due to divorce, death of spouse, or long-term health-care responsibilities, the following criteria is required:

- Residency Reclassification application

- Copies of the requesting student’s valid Utah driver’s license, active voter registration, and, if applicable, valid vehicle registration (See Domiciliary Tie Deadlines here)

- Documentation of the extenuating circumstance for situations such as divorce, death of spouse, or long-term health care responsibilities of family members necessitating relocation to Utah:

- All relevant evidence concerning the motivation for the move shall be considered on a case-by-case basis.

- Documentation should support and verify that the student’s relocation to Utah is for reasons other than higher education.

- Specific circumstances for qualification are listed in R512, Determination of Resident Status.

For moving to Utah due to refugee status placed directly in Utah, the following criteria is required:

- Residency Reclassification application

- Documentation of the extenuating circumstance for refugee status placed directly in Utah:

- INS Document Number I-94

- Written confirmation from a refugee placement agency that assisted their move to Utah, such as:

- International Rescue Committee

- Catholic Community Services of Utah

- Asian Association of Utah

Ready to apply?

Post Submission Form

If you have already submitted your residency application form and have additional documents you wish to turn in for evaluation, please attach the documents using the:

If you are requesting residency for a spring term, all of the above documentation is required.

For the federal tax return requirement, you can submit:

- The first two pages of your federal tax return for the most recent tax filing year (likely the tax year ending 13 months before the start of the spring semester the student is applying for, example: 2022 tax year for spring semester starting in January 2024) verifying that you were not claimed as a tax dependent by out-of-state parents or guardians.

- Copy of your out of state parents’ or guardians’ federal tax return(s) for the most recent tax filing year (likely the tax year ending 13 months before the start of the spring semester the student is applying for, example: 2022 tax year for spring semester starting in January 2024) verifying that they did not claim you as a dependent.

- A signed and dated letter on letterhead from a licensed CPA with contact information, verifying that you are not claimed on federal taxes for the previous year as a dependent by out-of-state parents or guardians.

- Example: If you are applying for residency for Spring 2024, you can submit either your or your parents’/guardians’ filed federal tax return for 2022 federal taxes verifying that you were not claimed as a dependent by out-of-state parents or guardians, or a signed and dated letter on letterhead from a licensed CPA with contact information, verifying that you will not be claimed on federal taxes for the 2022 tax year as a dependent by out-of-state parents or guardians.

Please note that per the Board of Regents and University of Utah Institutional Policy, no time spent during the 12 months prior to the term for which resident student status is being sought* on the following programs can be used towards Undergraduate One Year Rule or Graduate Policy residency reclassification requirements:

- Western Undergraduate Exchange

- Western Regional Graduate Program

- Professional Student Exchange Program

- Utah Tech Good Neighbor Program

- International Student Exchange

- Alumni Legacy Scholarships

- Other programs as specified by the state or institution

- More information can be found in the mandatory reading of the University of Utah Institutional Policy and the Board of Regents Policies, R512.

*Any student wishing to reclassify as a resident for tuition purposes after completing 12 months of residence in Utah must not have spent time during the same 12 months on any of the above programs.

Late Application Submissions

An application is considered late if it is submitted after the deadline (see “Residency for Tuition Purposes Calendar” above).

The hard late deadline for application submission is the tuition deadline. No application will be accepted after the tuition deadline for the requested term of reclassification.

Late Documentation

Required documentation (proof of physical presence documents, submission of Utah ties, proof of tax independence documents, etc.) will be accepted through the census deadline of the requested term of reclassification at the latest. Documentation should be submitted as soon as possible prior to this deadline. No documentation will be accepted after the census deadline for the requested term of reclassification.

Students submitting documentation must have a residency reclassification application on file that was submitted by the hard application deadline.

“Domiciled” is defined by Utah law as:

- R512-3.2 Definitions “Domicile”:

- “(1) bodily presence; (2) fixed permanent home and principal establishment to which if absent, the [domiciled] intends to return; and (3) concurrent intent to voluntarily reside permanently in that location, not for a special or temporary purpose.

- see also R512-5.3.9 “Parent Domiciled in Utah for at Least One Full Year”

“Extenuating Circumstances” are situations such as divorce, death of spouse, or long-term health care responsibilities of family members necessitating relocation to Utah (see USHE R512-5.4.2)*, or refugee placed directly in Utah.

Nonresident Utah High School Graduates

Some students may qualify to have their nonresident tuition portion waived through nonresident tuition waivers House Bill 144 or House Bill 118

Information on House Bill 144 & House Bill 118 tuition waivers, as well as the application, are available here:

Have Questions?

Residency Office Contact Information

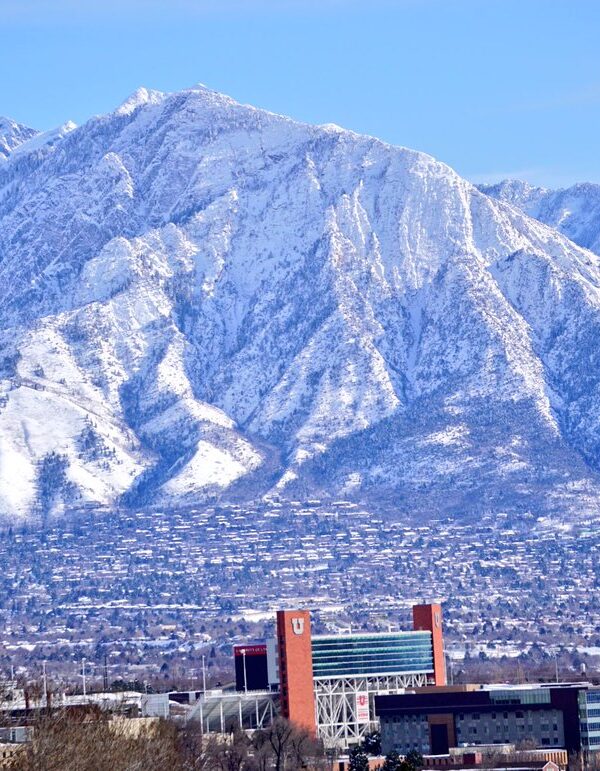

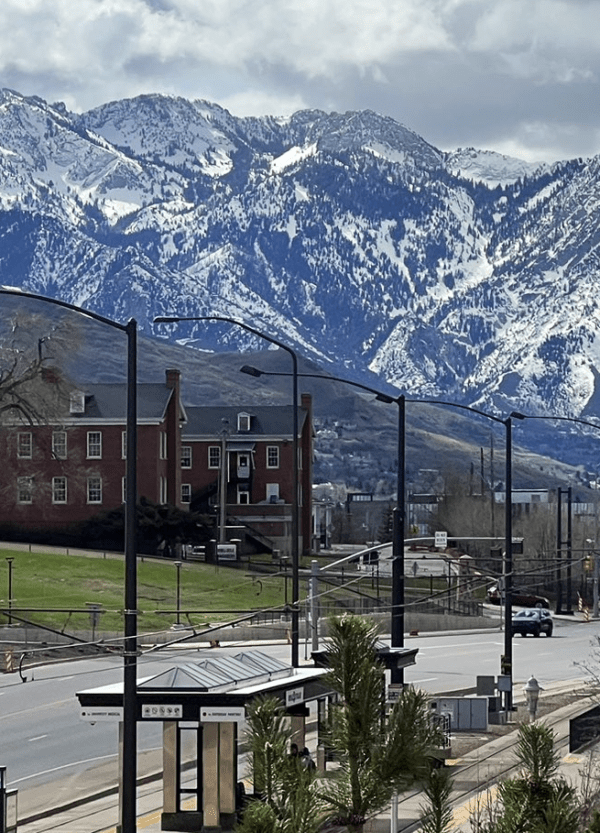

Visit us at:

201 S 1460 E, Salt Lake City, UT 84112

Office Hours (All times are Mountain Time Zone):

- Monday – 8:00 A.M. to 5:00 P.M.

- Tuesday – 10:00 A.M. to 5:00 P.M. (Staff Meetings every Tuesday morning 8:00 to 10:00 A.M.)

- Wednesday – 8:00 A.M. to 5:00 P.M.

- Thursday – 8:00 A.M. to 5:00 P.M.

- Friday – 8:00 A.M. to 5:00 P.M.

Closed all holidays and University Office Closure days (click here to see our calendar)

2024-2025 Holiday Schedule

Call us:

801-581-8761, Option 5 to speak with a Residency staff member

Email us:

Join a Zoom Q&A: