Proof Of Physical Presence For Residency

Proof of Physical Presence Requirements

For residency applications that require proof of physical presence for a 12-month continuous timeline, students must submit proof of their physical presence in the state of Utah for:

- A minimum of 12 consecutive months immediately prior, within no more than 23 months (one year and 11 months) immediately prior, to the term the student is applying for resident student status

- With no more than 29 days total with presence unaccounted for or outside of the state of Utah

- Any days that a student cannot prove their presence in Utah by one of the accepted methods will count against the 29 day total

- Students are expected to submit documentation proving any days they leave the state of Utah

ALL SUBMITTED DOCUMENTATION is subject to review; acceptance is not guaranteed

What do the documents need?

Documents must contain all three required pieces of information on each document to be accepted:

- Student’s name

- Exact date or dates

- Exact location of the student completing an event (in-person, physical event; documents for a location itself (and not for the location of an event that the student did), such as for housing, are not accepted. This includes rent payments, housing contracts, mortgage payments, property taxes, utilities payments, property ownership documentation, etc.)

Any document, that cannot prove the student completed a specific event, at a specific location and date is invalid as proof of physical presence.

Proof of Physical Presence Documents

-

IN-PERSON CLASSES ONLY

Proof from first day of semester until last day of finals

- Completed semester transcripts showing in-person enrollment at the University of Utah

- Student must be present for at least one in-person class; no transcripts that show only online classes are accepted

- Residency staff opens these up with the student’s University of Utah records; student does not need to submit University of Utah transcripts

- Completed semester transcripts showing attendance at the University of Utah Asia Campus. The Residency Office can use these transcripts to prove the students physical presence “in Utah” for all students who attend Asia Campus, since it is officially the University of Utah.

- Student must be present for at least one in-person class; no transcripts that show only online classes are accepted

- We use this transcript as proof from first day of semester until last day of finals, with a travel period 7 days before the first day of semester, and 7 days after the last day of finals.

- Residency staff opens these up with the student’s University of Utah records; student does not need to submit University of Utah transcripts

- Or transcripts from another Utah institution

- Residency staff must be able to verify classes were taken in person, not online

- Residency staff must be able to verify semester beginning and ending dates (first day and last day of finals respectively)

- Completed semester transcripts showing in-person enrollment at the University of Utah

-

MUST BE REQUIRED UNIVERSITY OF UTAH PROGRAMS

Letter needs a U of U staff member letterhead and signature

University of Utah-sponsored programs with supporting documentation and institutional verification

- These can include:

- University of Utah sports

- University of Utah study-abroad

- University of Utah-sponsored internships

Acceptable documentation (see University of Utah Institutional Policy, page 9, “STUDENTS ON UNIVERSITY OF UTAH SPONSORED PROGRAMS”):

- Submit a signed and dated letter on letterhead from the University of Utah organizing department with the student’s name, student’s UNID identification number, the exact dates of the program, and where the program was physically located

- This letter MUST VERIFY:

- The internship, courses, study abroad programs, or athletics are required by the University

- Details of how these programs satisfy the requirements for the student’s major and/or area of study

- Letter needs a U of U staff member contact information and signature

Programs from University of Utah affiliates are not accepted (clubs, faith groups, sororities/fraternities, etc.).

- These can include:

-

OFFICE CHECK-INS AT RESIDENCY OFFICE

Every 7 days or fewer

- Physical Presence Office Check-Ins at the Residency Office window, at least once every 7 days or fewer for the date range the student wishes to prove

- Office of Admissions business hours only

- University of Utah Student Services Building, 201 S 1460 E, Salt Lake City, UT 84112 (Click here to take a look at the Campus Map to find the Student Services Building)

- Monday through Friday, 8:00 AM to 5:00 PM Mountain Time

- Closed all holidays and University Office Closure days (click here to see our calendar)

- Office of Admissions business hours only

- Student must bring their University of Utah ID card, and another form of photo identification, such as a driver’s license

- Physical Presence Office Check-Ins at the Residency Office window, at least once every 7 days or fewer for the date range the student wishes to prove

-

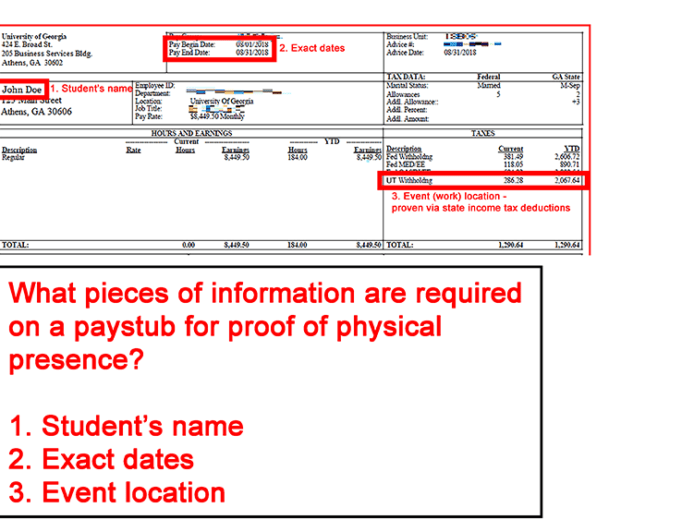

PROOF FOR THE PAY PERIOD DATES

Must show work done in Utah via state income tax deductions

Paystubs:

- Official dated paystubs only; spreadsheets, personal checks, or other non-official documents are not accepted

- Paystubs must show all three required pieces of information, student’s name, pay begin and end dates, as well as:

- Proof of labor done in Utah via Utah income tax withholding/deduction

- Income tax withholdings for other states are counted as proof of labor being done outside of Utah

- Student’s/employee’s address not counted as proof of physical presence

- Company’s address not counted as proof of physical presence

- Proof of labor done in Utah via Utah income tax withholding/deduction

- See an example of acceptable paystubs here

- *Please see “The following CANNOT be used…” below for information regarding self-employment records.

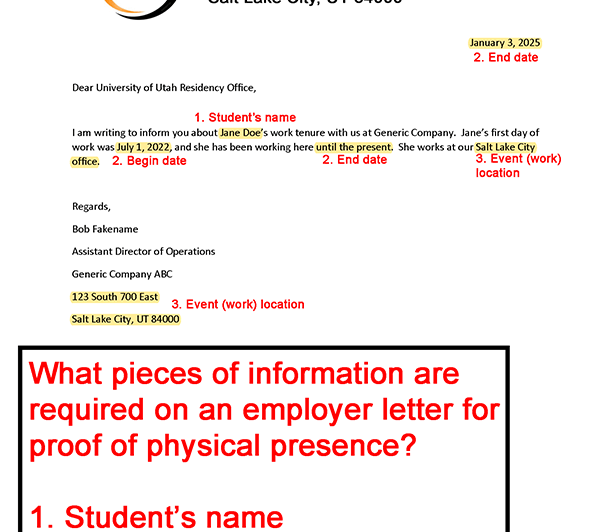

Employer Letter:

- A signed and dated employer letter on letterhead specifying:

- Name of the student/employee

- Dates of beginning and ending of employment with a Utah employer

- Detailed information about employee’s schedule and how often they worked

- Exact location of where work was done

- Letter must come from company personnel with access to student’s/employee’s beginning and ending work history; a direct supervisor, human resources, or other administrative personnel

- Official letterhead required in order to verify the company’s information

- See an example of an acceptable employer letter here

- *Please see “The following CANNOT be used…” below for information regarding self-employment records.

-

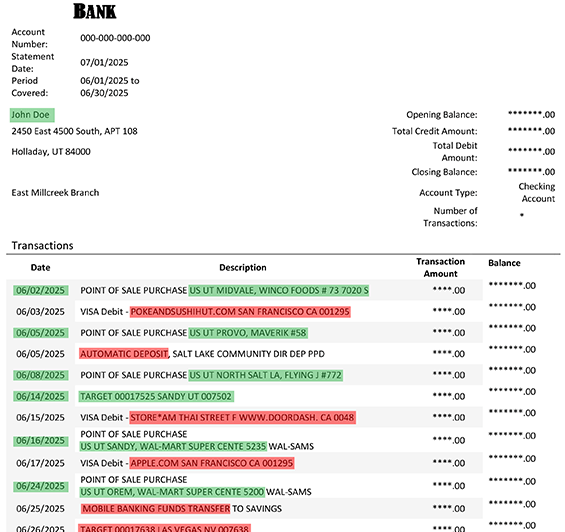

IN-PERSON PURCHASES, MADE BY THE STUDENT, AT LOCATIONS IN UTAH

Every 7 days or fewer

- Bank or credit card statements, in the student’s name, showing the student made in-person, in the state of Utah, purchases at least once every 7 days or fewer for the date range the student wishes to prove.

- The student is required to prove that they were physically at a location making a purchase; these purchase records MUST be able to be documentarily linked to the individual student.

- Bank accounts with multiple account holders must be able to provide statements that can specify who made each purchase, either by means of displaying distinct card numbers for purchases, or by means of separating all of the purchases by each different account holder’s name.

- If the bank statement cannot prove who made which purchases, as well as where and when, then that document is not acceptable as valid proof of physical presence for the student.

- Purchase records must have proof of physical location for each purchase.

- Online purchases are not accepted.

- Online service purchases (Uber, Lyft, Doordash, GrubHub, etc.) are not accepted.

- Online fund transfers (Venmo, PayPal, Zelle, etc.) are not accepted.

- Direct deposits and electronic transfers not accepted.

- In-branch or physical ATM deposits or withdrawals may be accepted, if the bank statement shows the physical location, in Utah, where a deposit or withdrawal was made, and if it shows that it was made by the student applying for residency. Generic information that omits either or both the name of the person and the location cannot prove the physical presence of the student for that event, and thus it is invalid as a proof of physical presence.

- See an example of an acceptable bank statement here

-

MUST HAVE PROOF OF BEING A UTAH LOCATION

Every 7 days or fewer

- Gym records in the student’s name

- Verifiable name and contact information for the Utah-located gym

- Residency staff must be able to independently verify that the gym is located in Utah, especially for a national franchise such as Planet Fitness, VASA, etc.

- In person visits to a Utah gym at least once every 7 days or fewer for the date range the student wishes to prove

-

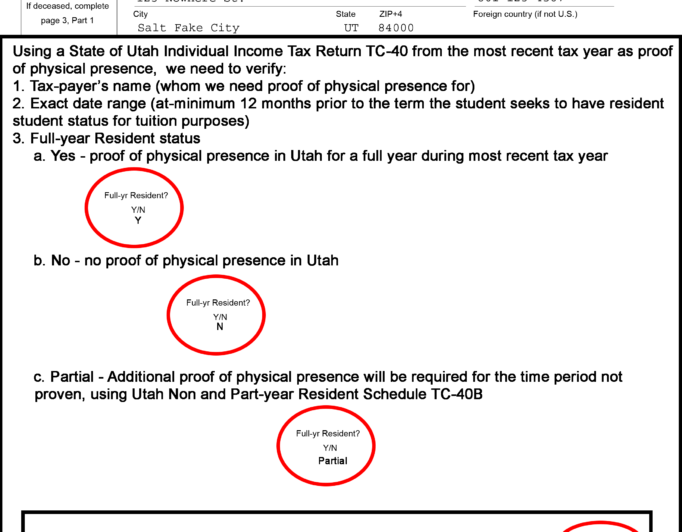

UTAH TC-40 CAN PROVE SOME OR ALL OF THE 12 MONTHS FOR PROOF OF PHYSICAL PRESENCE

- A copy of the Utah state tax return TC-40 with “Full-yr Resident” marked “Y” for the filing from most recently filed tax year (see example here)

- A Utah TC-40 that marks the tax payer as a full year resident can be used for the full 12 months required, or for some of the 12 months required, depending on the timeline the student needs to prove physical presence in Utah.

- The Utah TC-40B Non and Part-year Resident Schedule that proves the months that a person was a part-year resident of Utah:

- Additional documents proving physical presence in Utah for the remaining months to complete 12 consecutive months, in combination with theTC-40B, will be required

- All documents, Utah TC-40B and others, must total a full 12-month period, with fewer than 29 days total unproven/out-of-state

- A copy of the Utah state tax return TC-40 with “Full-yr Resident” marked “Y” for the filing from most recently filed tax year (see example here)

-

SUBJECT TO REVIEW FROM RESIDENCY STAFF

No guarantee in advance if accepted

- In some cases, documents proving an event happened within the local community may be used:

- Letter from a local community leader (such as a bishop, pastor, volunteer organization leader, club leader, etc.) verifying your attendance for specific dates, and verifying the location of where these events happened.

- After-care Summary from a health care visit

- Doctor

- Mental Health

- Hospital

- Outpatient treatments

- Log-in reports from volunteer service

- Sign-in sheets from verifiable local organizations (clubs, sports teams, meetings, volunteer groups, etc.)

- Local organization must be independently verifiable via internet, phone, email

- Sign-in documents must contain organization’s official information and contact details

All documents are subject to case by case review; no guarantee of acceptance upon submission

- In some cases, documents proving an event happened within the local community may be used:

-

- Other official documents that contain all three required pieces of information on each document may be accepted:

- Student’s name

- Exact date or dates

- Exact location of an event (in-person, physical event; documents for a location itself, such as for housing, are not accepted, rent, mortgage, utilities, etc.)

- Examples may include:

- Printed airline boarding pass with departure/arrival airport

- Airline ticket email receipts are not accepted, only physically printed boarding passes

- Digital boarding passes (like in Apple Wallet) do not contain all the required information (student name, exact date, exact location), instead, they contain a QR code, which we cannot access, and are thus not accepted

- Ski passes to Utah ski resorts

- Printed airline boarding pass with departure/arrival airport

All documents are subject to case by case review; no guarantee of acceptance upon submission

- Other official documents that contain all three required pieces of information on each document may be accepted:

Examples of Proof of Physical Presence Documents

Paystubs

These show:

- Proof of student’s name

- Proof of exact dates (pay begin and pay end dates)

- Proof of labor done in Utah (Utah state income tax deductions)

Employer Letter

These show:

- Proof of student’s name

- Proof of exact dates (beginning hire date and work until date)

- Proof of labor done in Utah (Employer’s confirmation that the work was all done at a Utah location)

Bank Statement

This shows:

- Proof of student’s name

- Proof of exact dates (dates of transaction)

- Proof of purchases done in Utah (Utah address, or a store locator code that proves the store is in Utah)

Airline Boarding Pass

This shows:

- Student’s name (Clark Kent)

- Exact date of flight

- Proof that the student was at the airport to print out this boarding pass

Utah TC-40 Tax Return

This shows:

- Proof of tax payer’s name

- Proof of exact dates (tax year)

- Proof of Utah residence (marked “Yes” under “Full-Year Utah Resident”)

Letter for Move to Utah for full-time employment

This is a criteria requirement for the Move to Utah for Full-Time Employment reclassification policy.

The following CANNOT be used to demonstrate proof of physical presence (this list is not exhaustive):

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. Since utilities are not proof of an event or an action that the individual completes, rather, they are simply access at a given address to water, gas, electricity, or other utilities, these bill cannot be used to prove physical presence for a given time period.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. Since a housing agreement only shows that a person is contractually obligated for a unit of housing, be it an apartment, condo, house, or otherwise, and it does not demonstrate an action or event happening in-person, we cannot accept leases, rental agreements, home titles, property taxes, or any documentation that proves housing, as proof of physical presence.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. A W-2 is an annual summary of the income taxes for an employee, and that time period of a full year is too broad in order to prove regular proof of physical presence. In order for an applicant to prove state income tax deductions from their pay, and thus prove their labor was physically done in Utah, they would need to submit paystubs for the pay beginning and ending dates for the time periods they need to prove their physical presence.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. As with a housing contract, proof of property in Utah is not proof of the applicant’s physical presence that documents an action or in-person event that the applicant completed at a specific time and location in Utah.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. These records need to be unbiased, coming from some sort of third party. Since a personal statement from the applicant inherently has a conflict of interest, since the applicant writing the statement is the same person that stands to benefit from resident student status, we cannot accept this form of physical presence documentation.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. These records need to be unbiased, coming from some sort of neutral third party. Since a personal statement from the applicant’s associates inherently has a conflict of interest, since the applicant is personally involved with friends or family, we cannot accept this form of physical presence documentation. We cannot accept a letter from a landlord since they do not have accurate records of an applicants daily or weekly physical presence, only housing contract records which do not prove an in-person event or action, rather the contractual obligation to a housing unit.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. With the ease of online technology, any person from any location with internet access can make purchases with these types of independent contractor apps for travel, food or other services. As such, they are unreliable in proving that a specific person was transported or had goods delivered to at a specific location. They prove that a specific person purchased such services, but not that a specific person was physically located where the services happened.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. A photograph can be altered or manipulated in countless ways, and is an unreliable record to prove that a specific action happened at a specific location by a specific person. It is also not a verifiable document coming from a neutral third party.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. Social media posts can be created by anyone with login access to a social media account, and therefore cannot prove a specific person did an action at a specific location.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. Cell phone records are linked to a phone number, and not to a specific person, and thus they prove a cell phone was at a location, not a person.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. These records need to come from an unbiased, neutral source. In the case of paystubs or employment letters, that source needs to be someone with access to an employee’s employment records who can verify the physical location of where labor is performed. For letters, that source is a direct supervisor or a human resources specialist. For paystubs, that source is the payroll manager who handles deductions for state income tax for labor performed. For self-employed people, there is not a neutral source for those records, since the person who is the supervisor and/or human resources is the same person who stands to benefit from gaining resident student status. There are no neutral third party sources of documents that can prove that a self-employed worker performed all of their labor within Utah, and therefore, someone who is self-employed needs to use other records, such as bank statements showing purchases made at physical locations in Utah, class enrollment records proving attendance at in-person classes in Utah, gym punch-in records in Utah, Residency office check-ins at our office window, etc.

-

Proof of physical presence records need to prove some kind of in-person action taken, some kind of event that a person does physically in a specific location at a specific time. An online receipt for an airline ticket cannot prove the location of where any in-person actions were taken, they can only prove that someone bought a plane ticket. For proof of physically flying to or from a location, only a physically-printed out boarding pass from the airline will be sufficient.

Have Questions?

-

Visit us at:

Student Services Building,

201 S 1460 E, Salt Lake City, UT 84112Office Hours (All times are Mountain Time Zone):

- Monday – 8:00 A.M. to 5:00 P.M.

- Tuesday – 10:00 A.M. to 5:00 P.M. (Staff Meetings every Tuesday morning 8:00 to 10:00 A.M.)

- Wednesday – 8:00 A.M. to 5:00 P.M.

- Thursday – 8:00 A.M. to 5:00 P.M.

- Friday – 8:00 A.M. to 5:00 P.M.

-

Call us:

801-581-8761, Option 5 to speak with a Residency staff member

-

Email us:

-

Join a Zoom Q&A: